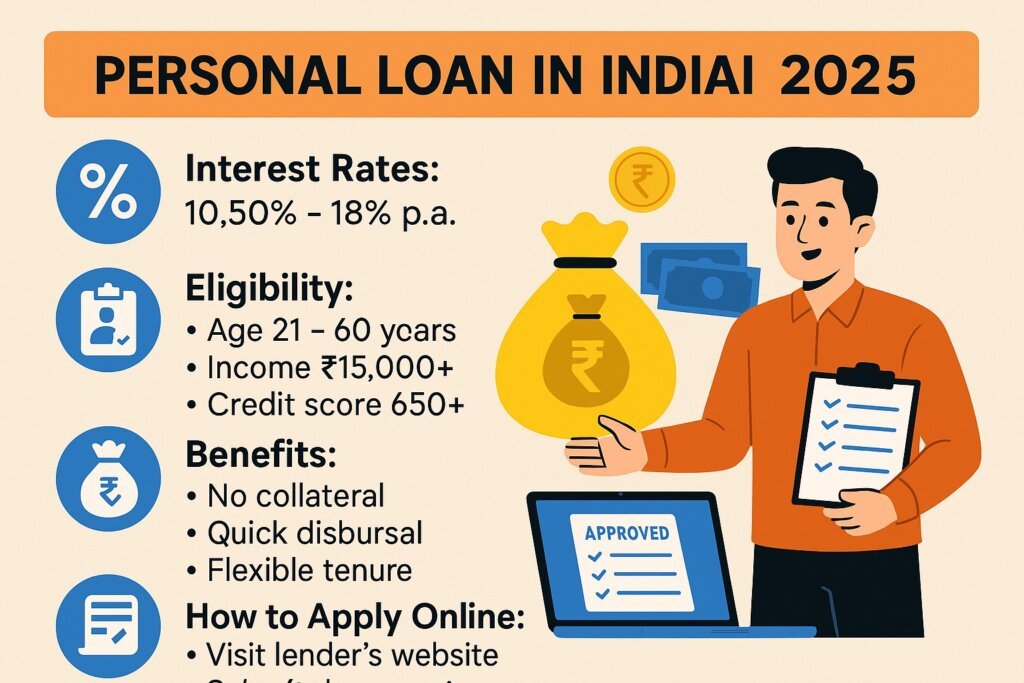

Personal loans have become one of the most popular financial solutions in India. Whether it’s for medical emergencies, wedding expenses, travel, education, or debt consolidation, a personal loan offers quick access to funds without collateral.

In this article, we’ll cover everything you need to know about personal loans in India in 2025, including interest rates, eligibility, documents required, benefits, and how to apply online.

What Is a Personal Loan?

A personal loan is an unsecured loan, meaning you don’t need to pledge any asset like gold, property, or a vehicle. Banks and NBFCs provide personal loans based on your income, credit score, and repayment capacity.

Personal Loan Interest Rates in India (2025)

Interest rates vary depending on the lender, your credit profile, and employment type.

| Lender Type | Interest Rate Range |

|---|---|

| Banks | 10.50% – 18% p.a. |

| NBFCs | 12% – 24% p.a. |

| Digital Loan Apps | 15% – 30% p.a. |

Tip: A higher credit score (750+) helps you get lower interest rates.

Eligibility Criteria for Personal Loan

To apply for a personal loan in India, you must meet these basic conditions:

- Age: 21 to 60 years

- Employment: Salaried or Self-Employed

- Minimum monthly income: ₹15,000 – ₹25,000

- Credit score: 650+ recommended

- Stable income source

Documents Required for Personal Loan

You need very minimal documents:

- Aadhaar Card / PAN Card

- Address proof

- Salary slips (last 3 months)

- Bank statements (last 6 months)

- Passport-size photo

Most online lenders offer paperless personal loans.

Key Benefits of Personal Loan

- ✅ No collateral required

- ✅ Quick approval & instant disbursal

- ✅ Flexible tenure (1–5 years)

- ✅ Can be used for any purpose

- ✅ Improves credit score if repaid on time

How to Apply for a Personal Loan Online

Follow these simple steps:

- Visit the official bank/NBFC website

- Choose the loan amount & tenure

- Fill in personal & employment details

- Upload documents

- Complete e-KYC verification

- Get instant approval & money credited

Some lenders disburse money within 24 hours.

Best Uses of Personal Loan

- Medical emergencies

- Wedding expenses

- Travel & vacation

- Education fees

- Credit card bill repayment

- Home renovation

Things to Check Before Taking a Personal Loan

- Interest rate & processing fee

- EMI amount

- Prepayment & foreclosure charges

- Hidden costs

- Loan tenure

Always compare multiple lenders before applying.

Is a Personal Loan Right for You?

If you need quick funds and have a stable income, a personal loan can be a smart financial option. However, borrow responsibly and ensure timely repayment to avoid debt traps.

Final Words

A personal loan in India is one of the easiest ways to meet urgent financial needs. With online applications, instant approval, and flexible repayment options, getting a personal loan has never been easier.

Compare interest rates, check eligibility, and apply wisely to save money.